massachusetts meal tax calculator

The advance payment required is the liability that must be reported on the line items identified above. Your average tax rate is 1198 and your marginal tax rate is 22.

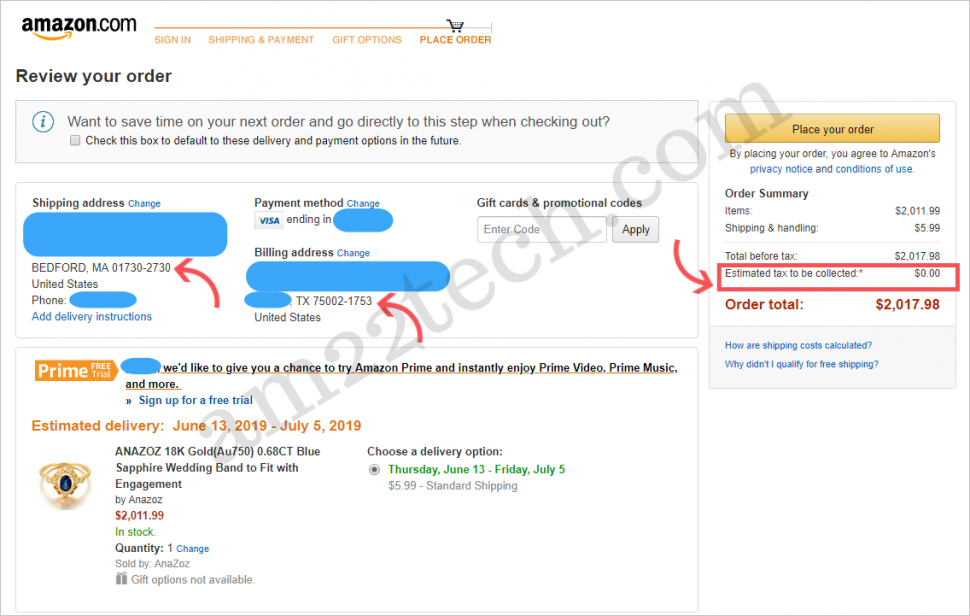

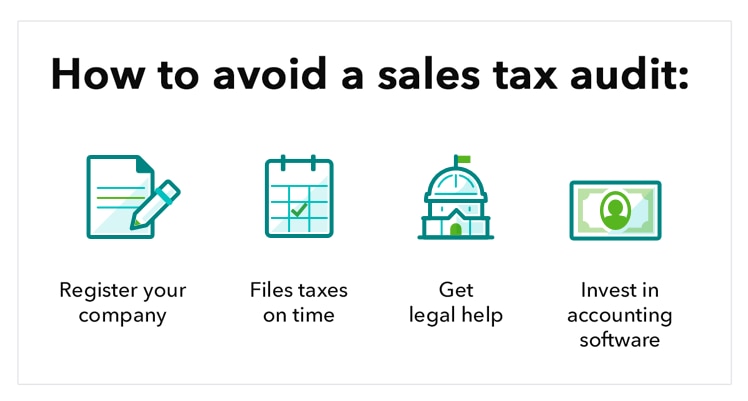

How To Calculate Sales Tax And Avoid Audits Article

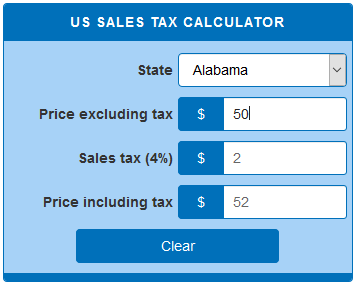

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. 15 Tax Calculators 15 Tax Calculators. The average cumulative sales tax rate in the state of Massachusetts is 625.

It may be based on either 1 the portion of the tax liability from the 1st. Also check the sales tax rates in different states of the US. 15-20 depending on the distance total price etc.

Massachusetts Paycheck Calculator - SmartAsset SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Most food sold in grocery stores is exempt from sales tax entirely.

C1 Select Tax Year. C2 Select Your Filing Status. The base state sales tax rate in Massachusetts is 625.

The Massachusetts Tax Calculator. As far as the prepared meals that are bought in the. This takes into account the rates on the state level county level city level and special level.

Estimate Your Federal and Massachusetts Taxes. The Federal or IRS Taxes Are Listed. Our free online Massachusetts sales tax calculator calculates exact sales tax by state county city or ZIP code.

Well speaking of Massachusetts there is a general sales tax of 625 on most of the goods which was raised from 5 in 2009. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where. The meals tax rate is 625.

This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules. 54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. This marginal tax rate.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold.

Hotel rooms state tax rate is 57 845 in Boston Cambridge. Start filing your tax return. Massachusetts has a 625 statewide sales tax rate.

And all states differ in their. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. A 625 state meals tax is applied to restaurant and take-out meals.

Single Head of Household. After a few seconds you will be provided with a full. Most food sold in grocery stores is.

Clothing purchases including shoes jackets and even costumes are exempt up to 175. A local option meals tax of 075 may be applied. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

1099 Tax Calculator How Much Will I Owe

Massachusetts Revives Plan To Change Sales Tax Collection Process For Merchants Paymentsjournal

Learn More About The Massachusetts State Tax Rate H R Block

Us Sales Tax Calculator Calculatorsworld Com

Massachusetts Sales And Use Tax Zip2tax Llc Accura

4 Ways To Calculate Sales Tax Wikihow

Sales Tax On Grocery Items Taxjar

States With The Highest And Lowest Sales Taxes

Massachusetts Income Tax Calculator Smartasset Com

Massachusetts Estate Tax Everything You Need To Know Smartasset

State And Local Sales Tax Rates 2018 Tax Foundation

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Woocommerce Sales Tax In The Us How To Automate Calculations

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Register File Taxes Online In Massachusetts